How To Withdraw Your R370/R350 Grant Without SASSA Card Using Cash Send Services If you forget your sassa card at home now is no more worries you can withdraw your Money anytime and Anywhere by Using Cash Send Services.

How to Withdraw Grant Without SASSA Card

There are multiple ways to withdraw your SASSA money without a card. I’ll divide them into three different methods as follows:

- Cash Send Option (ABSA, FNB’s E-Wallet, standard bank)

- SASSA Cardless Payment (SASSA OTP Withdrawal)

- Get Payment Directly in Your Personal Bank Account

reparation

Before you begin, ensure you have the following:

- Mobile Phone: To receive the one-time PIN (OTP).

- South African ID Card: For identification purposes.

- SASSA/Postbank Gold Card PIN: Required at certain withdrawal points.

1. Withdrawal Via SASSA Cash Send Services (ABSA, FNB & Standard Bank)

The first method is to withdraw your funds using cash send services such as ABSA, FNB’s E-wallet, and SASSA OTP withdrawal Standard Bank. They all have almost the same procedure to cash your funds. I’ll outline the step-by-step method for ABSA cash send withdrawals via ATMs and bank branches.

Cash Send Via ABSA’s ATM

Follow the below steps to withdraw your grant funds via ABSA:

Step 1: Locate and Visit Your Nearest ABSA ATM

Locate and visit your nearest Cash Send enabled ABSA ATM by using the branch locator. Please keep in mind that all ABSA ATMs don’t offer Cash Send, so confirm beforehand using the ABSA’s branch locator at https://www.absa.co.za/find-us/.

Step 2: Provide Your Phone Number for Transaction

Look for the Cash Send logo on the ATM screen. Click on it; it will ask you to provide your phone number. Now, provide the phone number that is associated with your SASSA grant.

Step 3: Verify Your Transaction By OTP

An OTP will be sent to your phone number. Enter that OTP PIN at the ATM screen.

Step 4: Receive Your Grant Money

Once the OTP is verified, you will be able to withdraw funds from your SASSA account. You can either withdraw the full amount or only the amount you need at the moment.

That’s all you need to withdraw your funds via ABSA.

Cash Send Via ABSA’s Bank Branch

If you are looking to withdraw via ABSA’s Bank branch, then you need to follow the below steps:

Step 1: Locate and Visit Your Nearest ABSA Branch

Find your nearest ABSA branch by using the branch locator. After finding the branch, confirm their opening timing and visit them during their working hours.

Step 2: Provide Your Phone Number TO ABSA’s Staff

Ask the branch staff that you are here to withdraw your SASSA funds via Cash Send. Staff will ask you to provide the phone number you used to register for the SASSA grant.

Step 3: Verify Your Transaction By OTP:

An OTP will be sent to your mobile phone. Provide that OTP to the bank staff.

Step 4: Receive Your Grant Money

After the staff verify your OTP, you will be able to withdraw your grant money from the ABSA’s branch. You can either withdraw your full grant amount or only the amount you need at the moment.

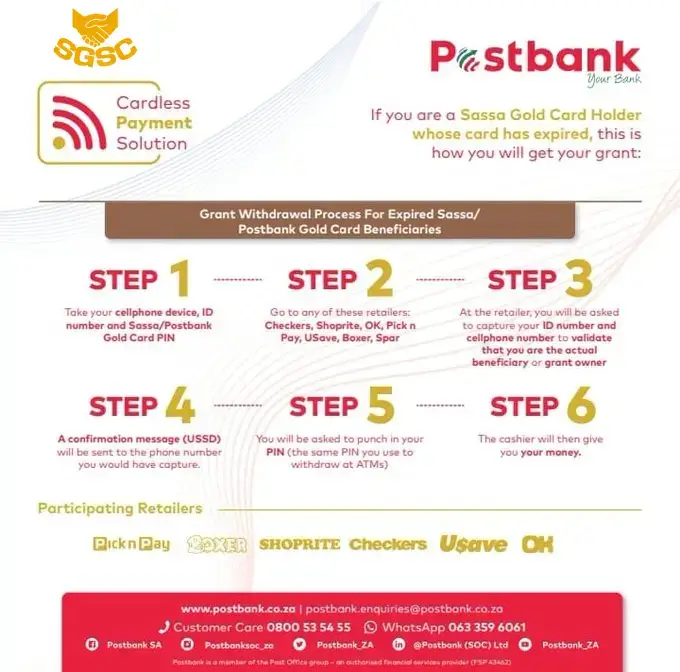

2. SASSA R350 Cardless Cash Withdrawal (SASSA OTP Withdrawal)

The SASSA R350 cardless cash withdrawal is also known as SASSA OTP withdrawal. For this method, you will need to use SASSA-Partnered retailers as your withdrawal method. There are six SASSA-partnered retailers listed below:

- Pick & Pay

- Shoprite

- Usave

- OK

- Checkers

- Boxer

- Spar

To use this withdrawal method, you will need to change your SASSA account payment method to Cash Send from the SASSA web portal at srd.sassa.gov.za. After that, you can get your grant money from any pickup of the above retailers. You will have to follow the following steps:

Step 1: Get the Necessary Things

Get your mobile phone, ID Card and SASSA/Postbank Gold Card PIN before visiting the pickup point.

Step 2: Find Your Nearest Pick-up Point

Locate your nearest pickup point of one of the SASSA-partnered retailers.

Step 3: Visit and Wait for Your Turn

Normally you will be facing long queues in pickup points. So, be patient and wait for your turn.

Step 4: Provide Your ID and Phone Number for Verification

At your turn, the staff will ask you to provide your ID number and phone number to verify that you are the actual grant owner.

Step 5: OTP Confirmation & Punching Your Pin

Now, a confirmation message will be sent to your phone number. The staff will also ask you to punch the PIN that you used to withdraw at ATMs.

Step 6: Get Your Grant!

After providing the correct PIN, the cashier will hand over your SASSA grant money.

That’s it! Now you have got your grant payment with SASSA cardless payment solution.

3. Get Payment Directly in Your Personal Bank Account

The most convenient way for me is to receive my grant payments directly into my bank account. You heard it right; this is one of the best methods as you don’t have to rely on any third sources further and receive all your grant money directly in your bank account.

For this, you will have to change your banking details from the SASSA web portal at srd.sassa.gov.za. Once the payment method changes to your bank account, you will start receiving your payments in your account from the next payment cycle. Please remember that the bank account must be in your name, as SASSA can’t pay your grant payments to anyone else’s bank account.

Which Cardless Withdrawal Method is Right for You?

Choosing the right way to withdraw your SASSA grant without a card can be confusing. Don’t worry; I’m here to help!

Cash Send, SASSA Cardless Payment, and Direct Bank Deposit each offer unique advantages and drawbacks. Let’s explore these methods to find the perfect fit for your needs:

1. Cash Send

2. SASSA Cardless Payment

3. Direct Bank Deposit

The best cardless withdrawal method for you depends on your priorities:

Best SASSA Cardless Withdrawal Method

Consider the following cardless SASSA withdrawal methods to find the best fit for you:

Cash Send (ABSA, FNB, Standard Bank)

- Pros:

- Fast and convenient.

- Available at many ATMs and branches.

- No need to visit a specific retailer.

- Cons:

- May have higher transaction fees.

- ATMs may be crowded.

- Best For: Those seeking speed, flexibility, and are comfortable using ATMs or bank branches.

Direct Deposit into Your Bank Account

- Pros:

- Convenient, with funds directly deposited into your account.

- No need to visit withdrawal points.

- Helps manage finances effectively.

- Cons:

- Requires an active bank account.

- Initial setup may cause delays.

- Best For: People with bank accounts who prefer ease and predictability.

Choosing the Best Method: Additional Factors to Consider

- Location: ATMs, bank branches, or retailers partnered with SASSA should be easily accessible.

- Comfort with Technology: Confidence in using ATMs or bank services.

- Personal Safety: Security concerns in different withdrawal locations.

- Financial Management Style: Preference for instant cash or automated direct deposits.